inheritance tax changes budget 2021

Are we going to see changes to Inheritance tax or Capital Gains Tax. In the ITR forms as applicable for the FY ended on March 31 2022.

Litrg Autumn Budget 2021 Round Up Low Incomes Tax Reform Group

Again with rising house prices more and more estates will see themselves falling within the Inheritance Tax net increasing the need for more detailed Inheritance Tax planning advice.

. Chancellor Rishi Sunak has announced a hike in corporation tax paid on company profits to 25 in 2023 and will freeze a whole host of tax-free allowances in a bid to claw back money spent during the pandemic. President Joe Bidens 2023 budget includes 148 billion for Social Security a 14 increase from 2021. But there were no announcements in the budget instead the Chancellor announced that there would be.

The current threshold is 325000. In a nutshell everything remains the same. Estate tax applies at the federal level but very few people actually have to pay it.

The exemption was 117 million for 2021 Even then youre only taxed for the portion that exceeds the. Anything over 325000 or any new threshold which is announced is subject to tax at 40. Much of the bump would go to help the federal agency improve its services at a time when it.

Not every estate is subject to IHT. 234 million for married couples at. The Conservative Manifesto of 2019 ruled out increases in income tax VAT and national insurance and while the Government could argue that Covid changes everything with regards to Inheritance Tax in particular the current Nil rate band of.

The inheritance tax nil rate bands will remain at existing levels until April 2026. The nil rate band will continue at 325000 the residence nil rate band will continue at 175000 and the residence nil rate band taper will continue to start at 2 million. By admin in Retirement Pensions October 6 2021 0.

Assets needed to be sold to pay inheritance tax for additional rate taxpayer. Assets needed to be sold to pay inheritance tax for higher rate taxpayer. Ercan Demiralay explains more about the tax and offers advice on what you can do to prepare your finances ahead of the changes.

The individuals are required to provide information related to income received form various sources such as salary rent etc. There is a threshold set by the government and subject to change and only estates which are worth more than the threshold must pay IHT. Both increases are in line with the Consumer Price Index.

The first is the federal estate tax exemption. However the announcement in the Budget is that thereafter these amounts will be fixed until at least April 2026. Prepare for potential changes to inheritance tax.

In 2022 there is an estate tax exemption of 1206 million meaning you dont pay estate tax unless your estate is worth more than 1206 million. Small increases to the income tax personal allowances for basic and higher-rate taxpayers from 12500 to 12570 and 50000 to 50270 respectively. The temporary reduced VAT rate of 5 for qualifying hospitality and leisure businesses will be extended for a further six-month period to 30 September 2021.

Experts expected inheritance tax IHT to be a likely target. Prior to announcing the Autumn Budget Sunak indicated he would fund spending pledges through tax rises. Following the release of Budget 2022 the 3 main thresholds remain as they were as does the rate of tax payable on any amounts inherited in excess of the thresholds.

This slowly increased to 175000 per individual in 2021. Changes To Inheritance Tax for Budget 2022. Worse if this gain took their Adjusted Gross Income over 1 million they would pay ordinary income rates on the capital gain plus the Net.

Inheritance Tax changes. A new reduced rate of 125 will then be introduced ending on 31 March 2022 before the rate returns to 20. Since 2018 estates are only taxed once they exceed 117 million for individuals.

The Autumn Budget at the end of this month is widely tipped to include a shake-up of inheritance tax. There is normally no Inheritance Tax to pay if someone leaves everything above the 325000 threshold to their spouse or civil partner Image. When I first agreed to write this article it was assumed that the March budget would include provisions to tighten up Capital Gains tax CGT and Inheritance tax IHT.

Assets needed to be sold to pay inheritance tax for basic rate taxpayer. The income tax return forms notified by the CBDT for FY 2021-22 have been kept unchanged. The speculation is that the current capital gains tax rates of 10 per cent and 20 per cent or 18 per cent and 28 per cent for property will.

Although we are unable to predict exactly what the 2021 Budget will hold please get in touch with our team of tax experts on 01274 733184 or email taxnaylorwintersgillcouk and will be happy to help you explore potential options based on your particular circumstances. IHT is largely paid on death. As previously announced the 202021 personal allowance will rise to 12570 as from 6 April 2021 whilst the 40 higher rate band will rise to 50270.

The Autumn Budget has frozen this useful nil rate band until at least 2026. Possible Inheritance Tax changes. The rate of tax payable stays at 33.

Ad Inheritance and Estate Planning Guidance With Simple Pricing.

Budget 2021 Summary And Highlights Taxassist Accountants

Budget 2021 The Verdict On Rishi Sunak S Plans Gaby Hinsliff Miatta Fahnbulleh Katy Balls And Tom Kibasi The Guardian

Budget 2021 Live Updates Nirmala Sitharaman Goes Digital Ditches Bahi Khata For Ipad Budget Speech At 11am In 2021 Budgeting What Is Budget Finance

Budget 2021 22 Punjab Doles Out Massive Uplift Funds For Pti Legislators Newspaper Dawn Com

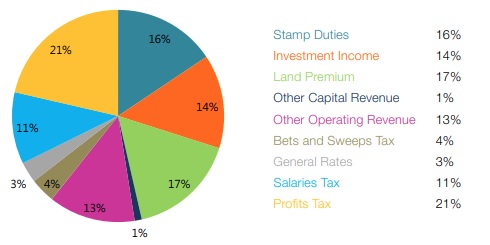

2021 2022 Hksar Budget Summary Tax Hong Kong

Autumn Budget 2021 Summary And Highlights Taxassist Accountants

What Has Budget 2022 Done For The Poor Quora

Cheaper Pints For Brits As Rishi Sunak Freezes Alcohol Duty And Extends Vat Cut

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

Pakistan Budget 2021 22 Real Estate Tax Changes And Analysis

What Is The Total Budget Of Pakistan Quora

Budget Summary 2021 Key Points You Need To Know Budgeting Income Support Business Infographic

Budget2021 Twitter Search Twitter

Top 10 Highest Paid Athlete In The World 2021 Https Www Moneyinternational Com Top 10 Highest Paid Athlete 2021 In 2021 Athlete Mohamed Salah Liverpool Kylian Mbappe

Union Finance Bill 2021 Budget 2021

Budget 2021 2022 Salient Features Of Measures Taken In Income Tax Pkrevenue Com

6 Tips For Purchasing The Best Bathroom Accessories In 2021 Sanitary Amazing Bathrooms Best